By Wang Zuoming and Li Chengzhi, Journalists of CNEWS, Taipei

DBS Bank canceled a credit card without warning, nullifying 4.7 million air miles valued at NT$8 million. CNEWS Confluence News Network received a consumer complaint stating that DBS Bank canceled a credit card without prior notice. This not only nullified the accumulated air miles but also failed to provide a reasonable response from the bank. More seriously, the card cancellation caused the consumer’s automatic insurance payments to be missed, severely affecting the consumer’s credit and leaving him with no recourse and deeply disheartened.

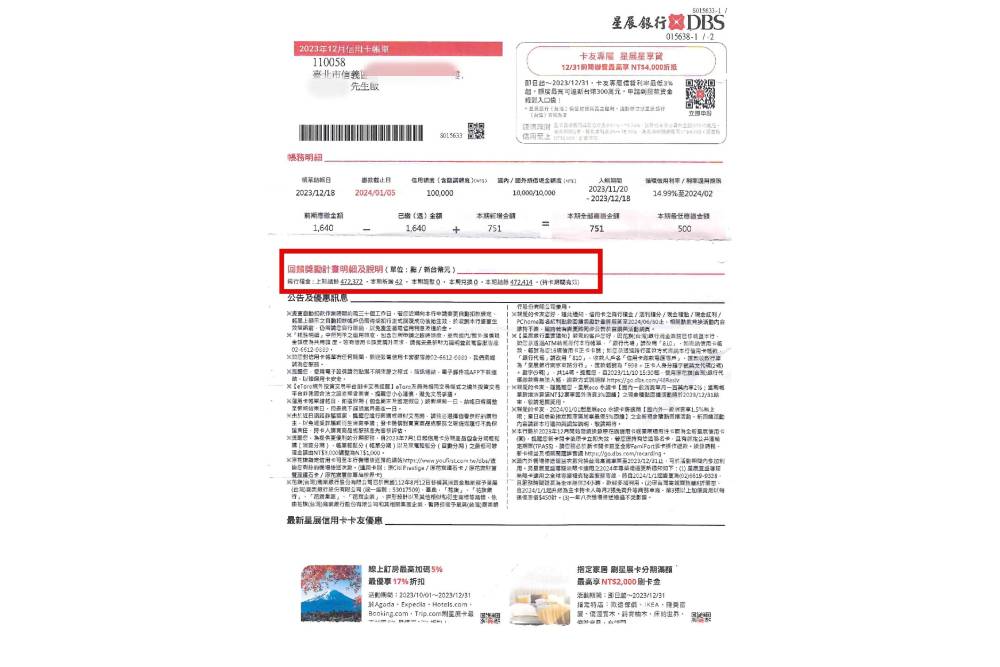

In 2019, Mr. W applied for the DBS Flying World Card, which promised “Swipe for miles, fly whenever you want.” The card was issued on August 5, 2019. Despite normal usage and no late payments, the card was suddenly canceled by DBS Bank on November 16, 2023, while still valid, causing the accumulated 472,414 air miles to be nullified instantly.

Mr. W stated that over the years, he had never missed a single credit card payment and received no notification from DBS Bank about the card cancellation. Upon discovering that Apple Pay had been deactivated, he called the bank for an explanation. The bank could not find a reason at the time and promised to investigate, but there was no follow-up from DBS customer service for six months.

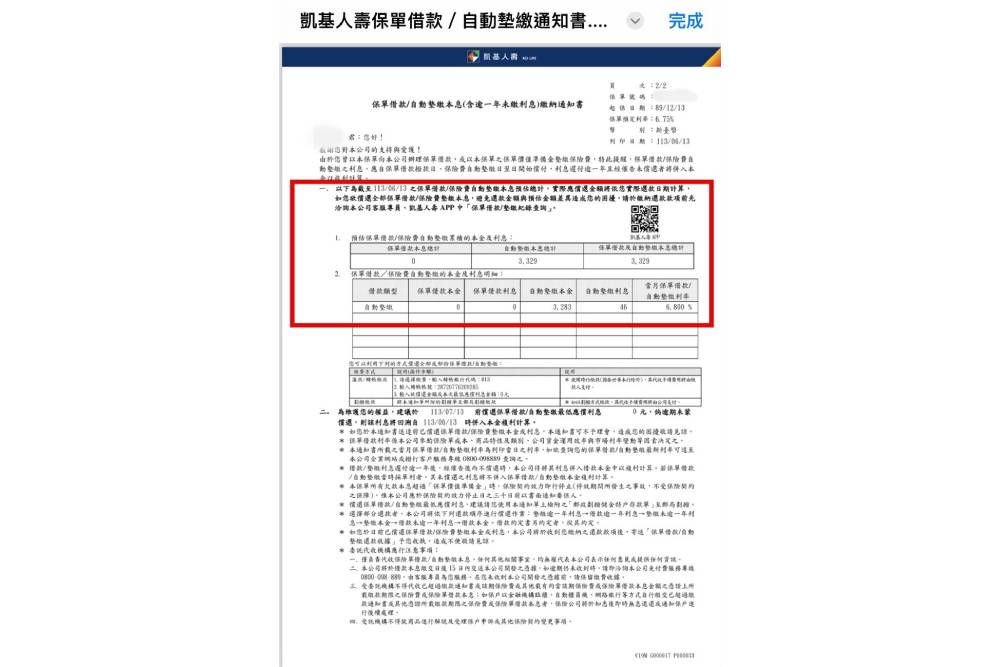

Mr. W did not notice the card cancellation because he had other valid credit cards and continued to receive monthly insurance premium notices. Only after inquiring with the insurance company did he find out that the premiums were supposed to be deducted from his DBS card, which had been canceled without his knowledge, causing the insurance company to send premium notices repeatedly.

▲It was only when he received a loan/premium notice that Mr. W realized his DBS card had been canceled, preventing premium deductions, and leading to automatic premium loans by the insurance company.

On June 14, Mr. W called DBS Bank to inquire about the card cancellation. After being transferred from customer service to account management, he asked for a detailed investigation. After half an hour of checking, the account manager couldn’t find the reason, stating “possibly due to credit bureau records,” and transferred him back to customer service. Customer service confirmed the 472,414 accumulated air miles.

Mr. W said that later that afternoon, DBS customer service called back but couldn’t provide a reason for the card cancellation, only stating that “the bank has the right to cancel the card based on subjective judgment.” When asked about the air miles, customer service firmly responded that “the points cannot be redeemed once the card is canceled,” without explaining the criteria. Mr. W’s years of effort in accumulating nearly 470,000 air miles were swallowed by the bank overnight, with no way to recover them. He questioned if this was a deliberate attempt by DBS Bank to swallow consumer points.

Mr. W estimated that the 470,000 air miles were equivalent to nearly NT$8.5 million in spending over four years, with an average annual expenditure of over NT$2 million. He questioned if foreign banks use such unclear methods to swallow consumer points as a way to make money in Taiwan, and if this was how DBS could afford to acquire Citibank.

Mr. W was further dissatisfied because the sudden card cancellation led to overdue insurance premiums, affecting his life security and potentially limiting urgent insurance claims. It also severely damaged his credit rating, affecting his financial reputation and causing significant damage to future financial transactions and activities.

Mr. W bluntly stated that DBS Bank is “the worst bank in Taiwan.” After researching online, he found he was not alone in his experience and questioned whether the Financial Supervisory Commission was properly supervising foreign banks to protect consumer rights or allowing them to profit by infringing on consumer rights.

Mr. W believed that DBS Bank’s unreasonable behavior not only violated basic consumer trust but also betrayed his loyalty and trust in using the credit card for many years. He called on DBS Bank to provide a clear reason for the card cancellation and restore his accumulated points. He emphasized that as a large bank, DBS should prioritize customer rights and provide transparent and fair services. He urged relevant authorities to investigate and supervise the matter to protect consumers’ legal rights.

Photo Source: Reprinted from DBS official website, provided by Mr. W

《More CNEWS reports》

【In case of article forwarding, please cite the source】

-

不挺醫界健保保障「1點1元」 衛福部長:避免給民眾太大壓力

-

8-2/DBS Bank Cardholder Complains About Sudden Credit Card Suspension; Netizens mock: “With Millions of Cardholders, They Can Suspend Anyone…Are They Acting Like Emperors?”

延伸閱讀

8-7/DBS Bank’s Unexpected Card Cancellation Infuriates Customers; Lawyer: Cardholders Can Seek Compensation

- 2024-07-01

- 張孝義

8-8/DBS Bank Faces Backlash After Zeroing Out 470,000 Reward Points; Consumers Speak Out

- 2024-07-01

- 潘永鴻

8-6/DBS Accused of Arbitrarily Zeroing Flight Miles, CFCT: Infringes Consumer Rights, FSC Has the power to sanction

- 2024-07-01

- 邱 璽臣